- Medtech Chopsticks

- Posts

- 🍜 Future of China's Medical Device Industry (Part 1)

🍜 Future of China's Medical Device Industry (Part 1)

Have you ever wondered what drives a decision? Friction arises when two sides have clashing interests.

That’s true for people, and it’s also true for national policy.

Take the current tension between the EU and China over the government tenders for medical devices as an example.

It made me ask - What triggered China to set its new course, and what does the next 10 years look like?

Once you see the “why,” everything seems to make sense.

So, what’s ahead for China’s device market?

🍜 The Market Situation

The United States, Germany, and Japan remain China’s top three sources of imported medical devices, together holding 51.3 % of the market in 2024.

Let’s break down the number further. So, U.S. is 23.8 %, Germany is 17.9 %, Japan is 9.6 %.

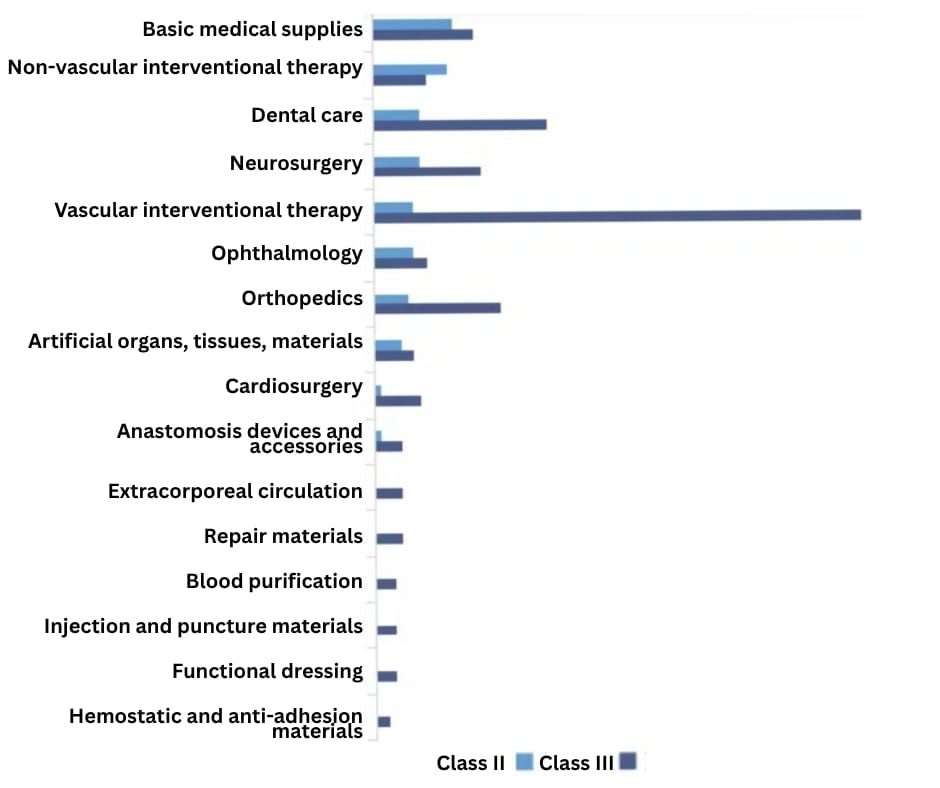

In 2024, new NMPA registrations for imported medical consumables were spread across 16 categories as shown below.

Source: JoinChain.cn - Medical Device Big Data

Vascular-intervention products ranked top on the list, with 92% classified as Class III medical devices.

Dental, neurosurgical, and orthopedic devices also saw strong traction, and Class III devices made up more than 69% of their totals.

China still depends on foreign suppliers for medium- and high-risk devices.

Domestic production lags in key areas, such as IVD reagents, high-value consumables, and high-end equipment, along with their critical materials.

These gaps give Western manufacturers room to grow, as local competition is still limited.

🍜 The Pitfalls

China has been focusing on the low-risk Class I and Class II devices and consumables. Margins are thin, and local competition is fierce.

The development of different medical segments is inconsistent. China lacks the necessary expertise and knowledgeable workforce to develop high-end devices.

Partly because skilled individuals decide to work and immigrate overseas. Foreign countries also harvest most of the know-how and advanced technologies.

The quality of the product may be vary, which leads to lower stability of the domestic high-end products.

Hospitals choose imported medical devices for better long-term safety and performance data.

At the same time, demand keeps climbing. China’s aging population and new chronic-care programs boost the need for rehab and home-care devices.

Medical, surgical, veterinary instruments, suture needles, vascular stents, pacemakers, surgical robots, devices that support people with physiological defects or disabilities have strong import potential.

Capital is another gap. Companies and developers often look for a quick launch, not for long R&D cycles.

Big multinationals that build or co-develop high-end devices will find open doors, fast-track reviews, and local incentives.

🍜 Chasing Northern Stars

This year, NMPA released a policy aimed at steady, long-term growth for China’s pharmaceutical and device sectors. It sets two bold deadlines.

Milestone 1: 2027

Regulatory system - Improve the regulatory framework for existing pharmaceutical and medical devices.

Efficiency - To reduce the review and approval timelines of the innovative drugs and medical devices. To increase the efficiency of the process.

Inspection - To strengthen the surveillance of the lifecycle management of the medical devices to improve the quality and safety

Intellectual property - To establish a regulatory system suitable for innovative pharmaceutical and medical devices. This includes tightening of the patent and intellectual property rights for the innovators.

Milestone 2: 2035

In the period of 10 years, China is planning to imprint a stronger innovation and increase global competitiveness with a consolidated and advanced regulatory system.

Highest standards - To ensure that products on the market are safe and effective.

Globalization - To cultivate the scientific development and technological improvements to an international level.

Regulatory framework - To establish a regulatory system suitable for the industrial development of innovative pharmaceutical and medical devices.

🍜 The Roadmaps

To reach its northern stars, NMPA will implement the following initiatives for medical devices:

Clinically urgent devices

Provide pre-submission support to the applicants. Facilitate the priority review of the medical devices with urgent clinical needs.

Green-channel testing

Prioritize innovative medical devices and medical devices for treating rare diseases in registration testing.

Post-market surveillance

Strengthen surveillance of the PMS platform for innovative medical devices based on the risk profile, and reinforce the proactive post-market actions

Localization

Streamline the review and approval process for imported medical devices. Announcement No. 30-2025 supports foreign innovators moving their production site to China, especially foreign-invested enterprises that will introduce high-end medical equipment.

Clinically urgent rare diseases

Allow specific medical institutions to import unregistered medical devices that treat clinically rare diseases.

Clinical trial review

Reduce the review timeline of the clinical trial from 60 to 30 working days.

One additional wrinkle about how China is promoting China’s exports:

Manufacturers that already meet China GMP may request export sales certificates even if the product is not yet registered and launched in China.

This is questionable, as foreign regulators may not recognize the certificate.

🍜The Prospects

China’s roadmap signals three clear openings for overseas manufacturers:

The opportunities for foreign manufacturers lie in three perspectives:

Mind the supply gap

Evaluate whether your product falls into the categories of high demand. For instance, hospitals still lean on imports for vascular-intervention, dental, neurosurgical, and orthopedic devices.

Target unmet clinical needs

China offers a special review pathway for devices that treat rare diseases or meet urgent clinical demand. This also applies to the high-end or high-risk medical devices that local makers cannot yet match.

Observe the shift of local policy

NMPA wants to reduce the time-to-market to attract foreign manufacturers to settle down. China targets on the cooperation that manufactures active pharmaceutical ingredients (API) and high-end medical equipment to transfer their production sites to China.

How will China’s strategy affect you? Stay tuned for Part 2. Book a complimentary strategy call here if you need a second opinion.

Disclaimer: This content is created solely in my personal interest and does not reflect the views, opinions, or policies of my employer or any other organizations I am affiliated with. Neither I nor my employer is liable for any use of this content. This newsletter does not compete with my employer’s interests. Any references to regulatory updates or guidance are based on publicly available information and are not intended to infringe upon proprietary or confidential content.